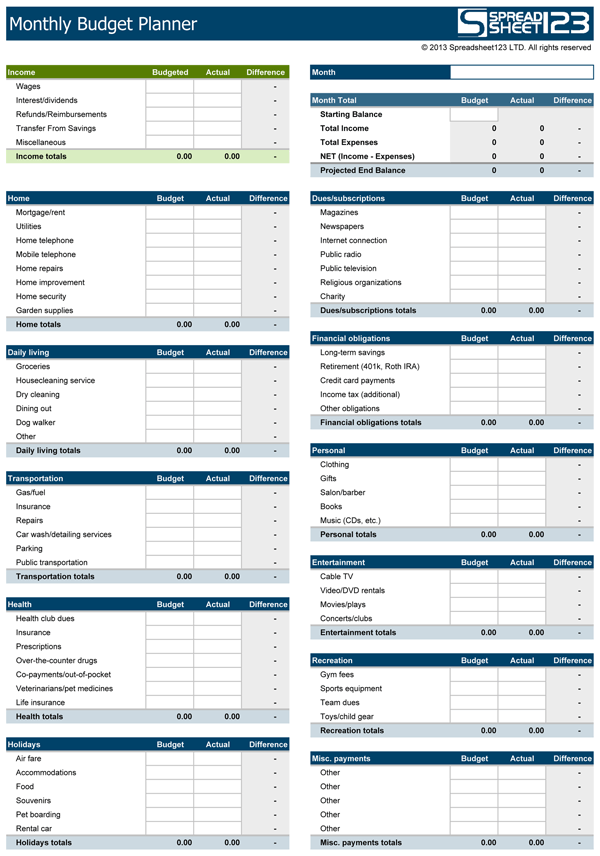

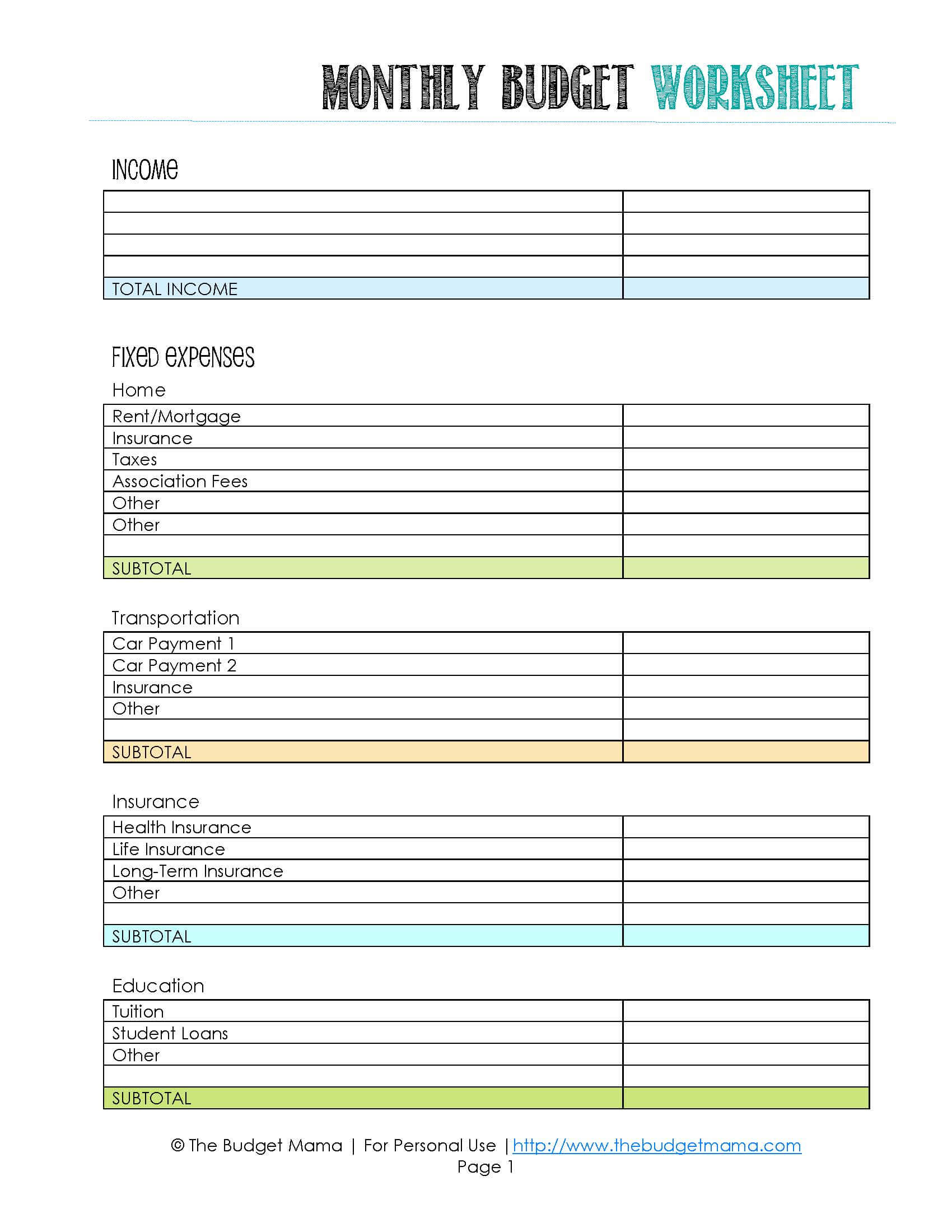

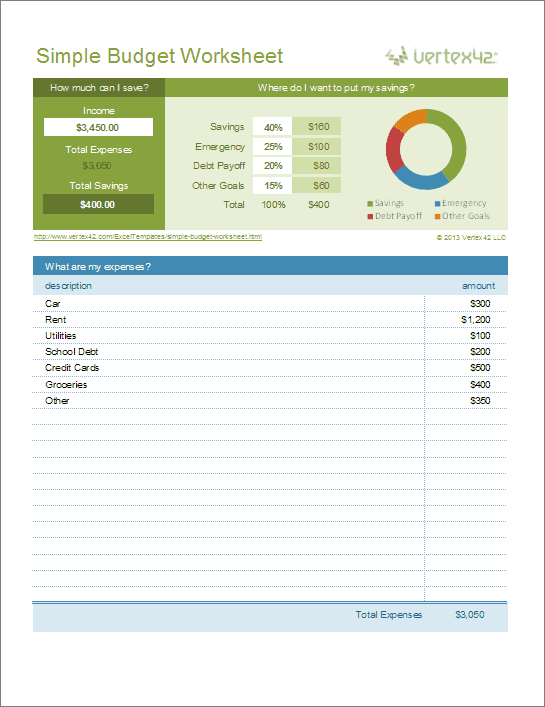

Your disposable income is what you have left to spend on your home budget categories. Want more specifics about what goes into these budgeting categories? Let’s dive in! Assembling Your Home Budget Categories The Essential Budget CategoriesĪll monthly budgets start with your disposable income - we can define this as the amount of money you take home from your paycheck after taxes, retirement savings, and other deductions. Recreation & Entertainment (5-10 percent).Saving, Investing, & Debt Payments (10-20 percent).It also offers suggestions for how much of your income you can contribute to each category. This guide reviews a list of budget categories found in a basic household budget. Once you’ve identified your basic budget categories, you can start allocating your spending based on your own individual financial circumstances. The first step involves breaking down your regular expenses into budget categories, in order to get a clearer picture of your spending patterns (including areas where you tend to overspend). A well-thought-out budget can help you take control of your finances and use your money with real purpose, so you have enough to pay your bills, grow your savings, and still enjoy life today. If you prefer working on a computer or hashing it out on paper, then check out these free, ready-to-use downloadable budget templates that will help you build a financial plan.To put it simply, a budget is really just a plan for your money. Understand where all your money actually goesĪ few weeks ago, we posted a list of our favourite mobile budget apps.

Always have enough money for the things you need and want.Maintaining a budget can help ensure that you: Getting started on a personal budget can be daunting and keeping it up can be a challenge. As you go along, it’s important to keep the big picture in mind. Regular check-ins to remind yourself about the long-term benefits of budgeting can help you become more intentional with your daily spending. Wait… budgeting brings happiness? Yes, it can! Take it from someone who used to loath it.

It wasn’t until I downloaded and started playing around with a few budgeting templates that I actually began to appreciate the process. Maintaining a balanced budget has not only brought me closer to reaching my personal goals, but it’s also made me feel more relaxed, and dare I say, happier. Some people love pouring over numbers. But for me, up until recently, the very idea of sitting down to work on a financial spreadsheet would make my eyes glaze over. Not only was it not on my to-do list, budgets and financial planning were something that I avoided altogether.

0 kommentar(er)

0 kommentar(er)